How I Achieved Early Retirement Before Turning 40

Written on

Chapter 1: The Path to Early Retirement

The journey to financial freedom can be frustrating, and I’m here to share four rather unhelpful tips that will likely leave you more annoyed than enlightened.

Picture a typical day of mine: drizzly weather, distant beaches, and a lack of companionship. I left my job just before I turned 39. While some hail this as an impressive feat, I would argue otherwise. My career journey can be distilled into four straightforward, albeit impractical, suggestions.

Section 1.1: Aim for a High-Paying Job Immediately

First on the list: secure a six-figure salary right off the bat. I squandered nearly a decade pursuing a Ph.D. You’d be better off landing a job that pays significantly more than the average income with only a high school diploma.

Consider those job offers you turned down during your final year of college from reputable companies known for good employee treatment. Many make the mistake of settling for entry-level roles lacking benefits or, worse, unpaid internships.

You should have chosen the position offering a salary in the 95th percentile, complete with annual raises that outpace inflation, bonuses hefty enough to fund first-class trips, stock options, and top-tier health plans. If you have a partner, ensure their salary at least matches yours—no freeloaders allowed!

If you opted for a lower-paying job, it's not too late to ask your employer for a substantial raise. Catching up is crucial, as generating significant income is merely the first step. Next, you need to figure out how to save it.

Section 1.2: Avoid Developing Hobbies

Next, make sure you have no enjoyable hobbies or interests. Whether it's something grand like piloting a plane or as trivial as collecting action figures, if you invest time and money into it, early retirement may not be for you.

In my late twenties, I discovered my aversion to dining out. I found that grilling my own burgers was not only quicker and cheaper but also a more pleasant experience. I also have little interest in amusement parks, cruises, or any of the typical leisure activities.

For me, early retirement isn’t a reward for hard work; it’s more of a fallback option after realizing all spending avenues have been exhausted. I leave the glamorous lifestyle and extravagant vacations to others—my preference lies in a quieter existence.

How We Retired Early With $540K At 40 In Colorado - YouTube

This video shares insights into the journey of a couple who achieved early retirement in Colorado with a substantial nest egg. They discuss their strategies and lifestyle choices.

Section 1.3: Timing is Everything

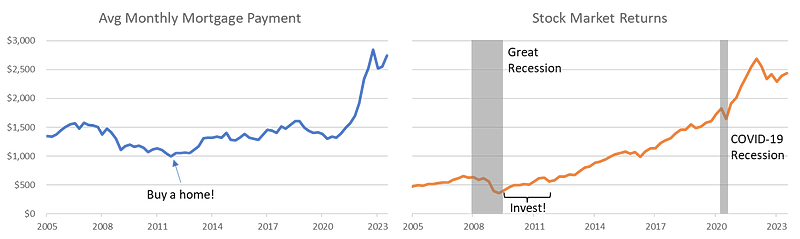

The third tip is to begin accumulating wealth during a significant market downturn. This is crucial for attaining financial independence. Imagine securing a home for less than half its market value with a low fixed interest rate; it was possible back in 2011.

While the location might not have been ideal, making some compromises could lead to substantial long-term gains.

If you invest wisely in index funds, you could see impressive returns without needing to engage in risky trades. Timing your high-earning years with a market rally is vital for anyone seeking early retirement.

The secret to my success? Pure luck with market timing. By saving diligently and earning well, you can set yourself up for success—provided nothing derails your plans.

Chapter 2: Committing to Consistency

The final tip is simple: maintain the status quo. Changes in your life often lead to increased expenses. Avoid having children, changing jobs, or pursuing further education. Stick to what you know, even if it’s not fulfilling.

Never allow any disruptions—stay healthy, avoid family emergencies, and ensure your partner remains employed. Once you own a home, never consider relocating or purchasing a second property.

You must also take steps to protect your home’s value against natural disasters and local economic downturns.

It's straightforward: Follow these four guidelines, and you might find yourself leaving your job sooner than expected. Generate substantial income, limit your spending, invest wisely during prolonged market booms, and avoid risks at all costs. My approach to financial stability may not be thrilling and is largely influenced by external circumstances.

How To Retire By 40 - How I Retired Early Through Starting A Business - YouTube

This video outlines the journey of a young entrepreneur who retired early by launching a successful business, sharing insights and tips on how to replicate this success.

Ultimately, instead of fixating on a retirement deadline, focus on what brings you joy and find a sustainable way to support that lifestyle indefinitely. It’s a more rewarding goal than merely achieving a target retirement age.