The Importance of Enhancing R&D Productivity in Defense

Written on

Understanding R&D Spending in Defense

In 2019, the United States allocated a staggering $55 billion towards defense-related research and development (R&D). Despite this significant investment, there is a notable lack of clarity regarding the tangible outcomes of such funding. The challenge lies in our inability to effectively measure the productivity of these expenditures.

Recently, on April 22, 2021, the Government Contracting Center at George Mason University hosted a webinar titled "Measuring R&D Productivity." The session aimed to delve into the concept of R&D productivity and assess how well the defense sector is performing in this regard. This discussion is particularly pertinent as debates intensify around whether the Department of Defense (DoD) is sufficiently funding R&D initiatives.

Key Questions Regarding R&D Investment

A crucial question arises: "Should we be increasing our R&D expenditures, and how can we determine the right amount?" Traditional metrics for R&D primarily focus on inputs such as the number of patents or PhDs. However, it is essential to consider outputs—what constitutes effective R&D productivity?

The webinar featured insights from Ann Marie Knott, who developed a method to gauge research productivity known as the Research Quotient (RQ). She was joined by Byron Callan from Capital Alpha Partners and Kevin Fahey, former Assistant Secretary of Defense for Acquisition. Ann Marie's metric allows organizations to assess their R&D productivity and benchmark against industry standards, offering a clearer picture for commercial enterprises. The panel's goal was to scrutinize the DoD's R&D spending and whether an increase is warranted, particularly in light of the substantial investments made by the tech sector.

A Brief Overview of Ann Marie's Research

Ann Marie's RQ is inspired by the foundational economic production function, which traditionally relies on capital and labor. She incorporates insights from Nobel Prize-winning economist Paul Romer, who emphasizes the significance of ideas and knowledge as critical inputs. According to Romer, "ideas make material progress possible." By framing R&D investment as an input and sales as an output, Ann Marie analyzed sales data over a seven-year period to evaluate research productivity. For more details on RQ and her findings, refer to the links provided at the end of this article.

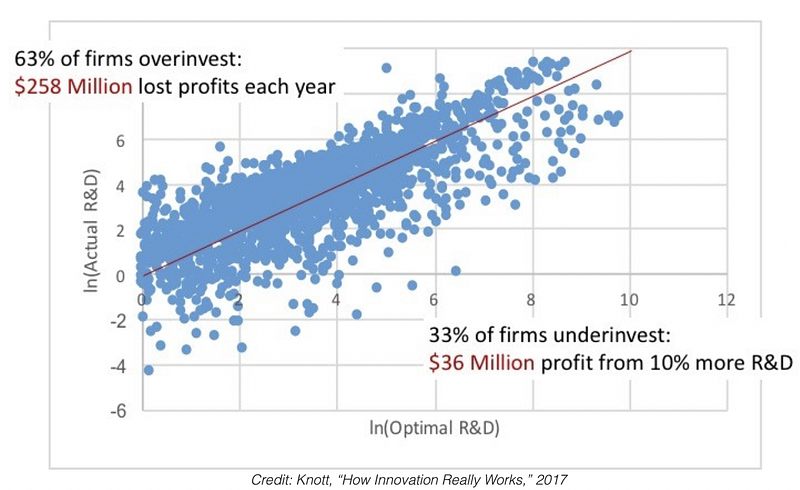

It's important to note that calculating RQ is not straightforward; it requires statistical estimation using sales figures in relation to R&D expenditures over time. The accompanying image illustrates the estimated RQ for firms using Compustat data up until 2011.

Key Insights on R&D in Defense

RQ offers an industry-specific benchmark for organizations operating within a sector, dating back to 1965 and extending into the future. While R&D spending and GDP growth exhibited a positive correlation until the 1980s, this trend has since stagnated, indicating diminishing productivity despite increased R&D investments. "Our objective is to encourage the industry to enhance their RQ, thereby revitalizing economic growth," Ann Marie stated. Currently, 63% of companies are overspending, while 33% are underspending, leaving only 4% in the optimal spending zone.

The average RQ results for each industry fall within a narrow spectrum, indicating its validity is confined to industry comparisons. Notably, best-in-class companies in each sector boast RQ scores that are four times higher than their industry's average.

During the panel discussion, the participants explored these principles and their implications for the defense sector. Although Ann Marie has not developed a direct method for measuring public sector productivity, sales or revenue cannot be utilized as outputs for evaluating government R&D spending effectiveness.

Insights from the Panel Discussion

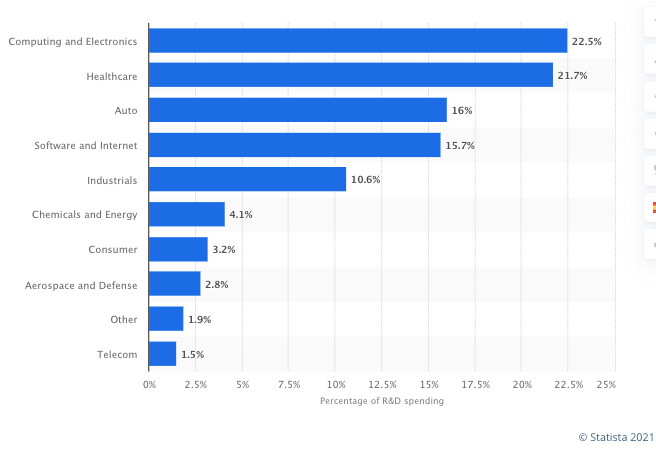

Defense sector public companies reportedly allocate only 2%-3% of their sales to R&D, in stark contrast to other industries, which invest an average of 16%, as noted by Byron Callan. A chart sourced from Statista outlines these disparities across ten industries.

This comparison underscores the necessity for the defense sector to boost its R&D spending. Even within the broader industrial sector, which includes defense, average expenditures hover around 10%. According to RQ, the defense sector exhibits greater productivity but is also at risk of overspending. This finding is both intriguing and thought-provoking.

Considerations for Future R&D Investments

One critical observation is that defense companies often present inconsistent calculations and portrayals of R&D in their financial disclosures, which may not align with their IR&D reimbursements. This inconsistency could obscure the true efficiency of their spending. Overspending does not inherently indicate that a firm should refrain from increasing its expenditures; rather, it suggests that firms must first identify the reasons behind their inefficiency and ensure their R&D efforts target appropriate markets.

This point is especially relevant for the defense sector, where stagnant sales hinder improvements in RQ. The defense budget is predominantly determined by the government and is not expected to rise significantly in the near term, raising questions about the potential for RQ to improve. However, it can be argued that R&D spending could fluctuate within the overall budget.

Moreover, the government has claimed that the IR&D expenditures of firms do not align with defense priorities. A study revealed that only 38% of IR&D spending corresponded with the ten specified areas for defense investment, indicating that 72% of IR&D activities yielded no results.

A Call for Increased R&D Spending

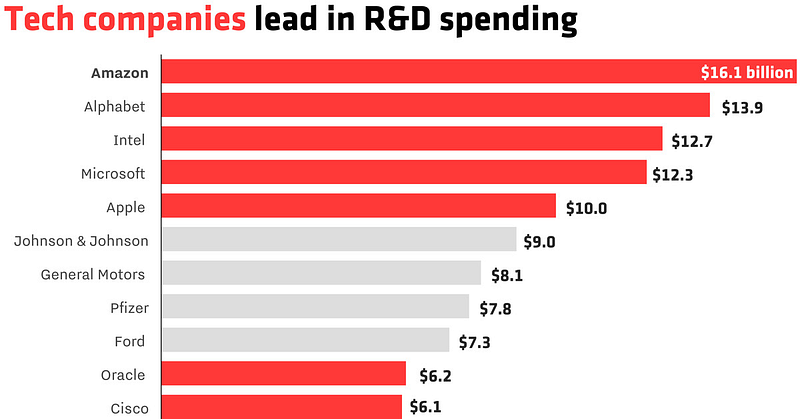

It is essential to avoid the misconception that the industry should not enhance its R&D investments. Ultimately, the volume of spending does play a critical role. As illustrated in the image below from Recode.net, Amazon invests $16 billion in R&D, far surpassing the combined budgets of the top five defense contractors and exceeding the budget of any single military research agency by at least eight times.

While Ann Marie's RQ indicates that the sector is performing well, it prompts further examination of how inputs correlate with outputs. Should outputs be redefined beyond traditional measures? Amazon, a leader in RQ, exemplifies effective targeting of R&D spending, adept management of projects, and an understanding of market demands. Analyzing Amazon's approach to knowledge creation could offer valuable insights.

Additional Considerations

It's crucial to recognize that RQ is a retrospective measure, not a predictive one. It does not aid organizations in anticipating future market needs or identifying valuable sectors. Nonetheless, tracking productivity over time can signal when further investigation is warranted.

Moreover, RQ does not account for the speed of innovation. A firm operating in a rapidly evolving industry may find its R&D productivity lagging, but this will only become apparent after the fact. Continuous assessment of performance is necessary to avoid disruption.

R&D expenses alone do not encompass other strategies for fostering innovation, including talent acquisition, partnerships, and mergers and acquisitions. Byron Callan has suggested that the venture capital model being adopted by some defense firms may offer a more agile path to achieving results—a concept worthy of deeper exploration.

Outsourcing R&D can often be detrimental, as firms may miss out on the benefits of knowledge generation. When R&D is outsourced, the company loses access to the personnel who conducted the research, hindering future innovation and growth. However, the life sciences and healthcare sectors present an exception, as biotech firms often serve as outsourced R&D providers for pharmaceutical companies, a trend that began in the 1980s.

Concluding Thoughts

The panel aimed to address how to enhance R&D productivity in the public sector, yet it seems to have raised more questions than answers—questions that merit careful consideration.

In summary, there is a pressing need to refine our understanding of R&D metrics in the public sector and determine the factors that contribute to fruitful R&D investments. Reducing spending does not guarantee increased productivity; instead, we must comprehend the interplay between various inputs, processes, and activities to identify effective levers for improvement. I propose that the existing processes may be hindering the proper framing of R&D challenges, while the most successful firms possess an innate ability to foresee and create new markets, as exemplified by Amazon.

Reference Links

- The Trillion-Dollar R&D Fix — Harvard Business Review

- Podcast: How Innovation Really Works with Anne Marie Knott

- RQ Consulting Firm: amk Analytics