Understanding Jamie Dimon's Perspective on Bitcoin and Inflation

Written on

Chapter 1: Dimon's Critique of Cryptocurrencies

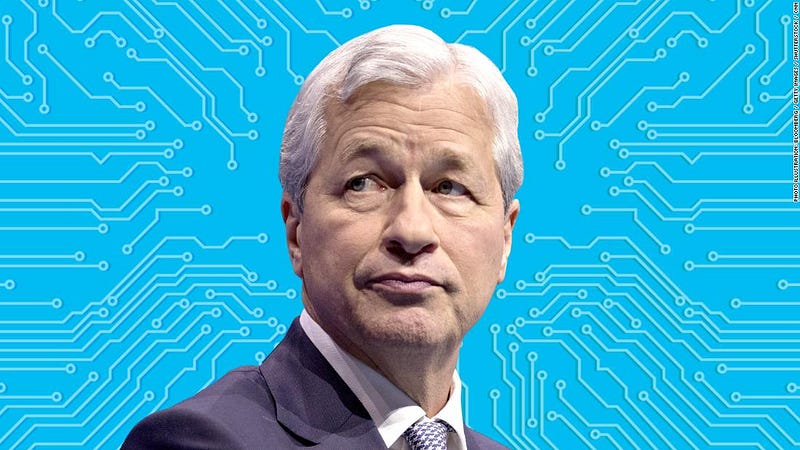

JPMorgan's CEO, Jamie Dimon, recently characterized bitcoin and other cryptocurrencies as “decentralized Ponzi schemes.” During his testimony before the U.S. House Committee on Financial Services, he labeled himself as “a major skeptic” regarding digital currencies like bitcoin. His comments emerged amid discussions with key figures from major American banks, where he also addressed economic prospects, the necessity for enhanced oil and gas production, and other pressing issues.

"This perspective is not new for Dimon, who has consistently criticized bitcoin, previously denouncing it as a 'fraud' and 'worthless.'"

Despite Dimon's skepticism, JPMorgan has gradually embraced cryptocurrency investments, recognizing significant opportunities for investors. Nonetheless, this hasn’t deterred Dimon from expressing his views. His consistent stance reflects a broader trend among influential financial figures, including Warren Buffett and Charlie Munger, who often group all cryptocurrencies together. Buffett famously referred to bitcoin as “rat poison squared,” a description that has resonated widely.

Section 1.1: Divergent Views in Legacy Finance

While Dimon’s views are well-known, they don’t represent the entire financial landscape. Major institutions like Fidelity and BlackRock hold differing opinions, with investors such as Paul Tudor Jones and Bill Miller labeling bitcoin as “the fastest horse” and “inevitable,” backing their beliefs with investments.

Subsection 1.1.1: My Stance on Dimon

I hold no ill will toward Dimon. I don't seek his advice on bitcoin, recognizing that many cryptocurrencies can be distractions or, in some cases, fraudulent. The events of 2022 highlighted that similar frauds seen in traditional finance are also present in crypto. The collapse of a prominent altcoin ecosystem, resulting in a $40 billion loss, showcased the risks involved.

Interestingly, I am a shareholder in JPMorgan and have been for years, even increasing my holdings multiple times last year.

Section 1.2: Economic Implications of Rate Hikes

Dimon's recent critiques coincide with a fresh round of Federal Reserve rate hikes. The Fed announced an increase of three-quarters of a percentage point, a decision echoed by several other nations, though Japan chose to maintain steady rates, resulting in a significant drop in the yen's value against the dollar. Regardless of interest rate fluctuations, inflation remains persistent and may worsen before improving.

Chapter 2: The Crypto Winter

When JPMorgan CEO Jamie Dimon Speaks, the World Listens | The Circuit - YouTube

As the term "crypto winter" gains traction, it’s essential to understand its implications. A crypto winter refers to a prolonged downturn in the cryptocurrency market, typically occurring in cycles. Bitcoin's market trajectory is influenced by the halving event, which reduces the rewards for miners by half approximately every four years, leading to increased scarcity and subsequent market rallies.

Following the last halving in May 2020, bitcoin experienced a remarkable bull run throughout much of 2021. However, ongoing challenges, including the aftermath of COVID, rising inflation, global supply chain issues, and geopolitical tensions like the Russian invasion of Ukraine, have adversely impacted both traditional markets and high-risk assets such as bitcoin.

JPMorgan CEO on inflation getting back to 2%: I'm a little bit of a skeptic on that too

The possibility of a global recession could extend the current bear market in cryptocurrencies. However, it’s crucial to maintain a long-term perspective, especially with the next bitcoin halving anticipated in 2024. While an extended crypto winter is not ideal, it’s not unprecedented. The year 2023 will be pivotal in shaping the outlook for bitcoin and the broader crypto markets.

Should global economic conditions improve more rapidly than expected, perhaps by early to mid-2023, we could see a more favorable investment climate for bitcoin leading up to the next halving. Conversely, if the current economic challenges persist, the market may mirror conditions from 2020–2021, with the next significant bull run potentially taking longer to emerge but likely hitting hard when it does.

Thank you for reading! Please note that I am not a financial advisor, and this should not be construed as financial advice. All opinions expressed here are solely my own. For more content like this, consider subscribing to my weekly newsletter.