US Tech Stocks: Are They the Top Investment Choice for the Next Decade?

Written on

Chapter 1: The Epiphany of Investing

There are moments in life that provoke deep reflection, often triggered by something we encounter in the media. Recently, a post on Zhihu, a Chinese platform akin to Quora, caught my attention. It drew parallels between the ongoing Ukrainian-Russian conflict and the collapse of Chinese stocks in 2007, prompting me to reflect on the current surge of global tech stocks.

A Golden Era for Emerging Markets

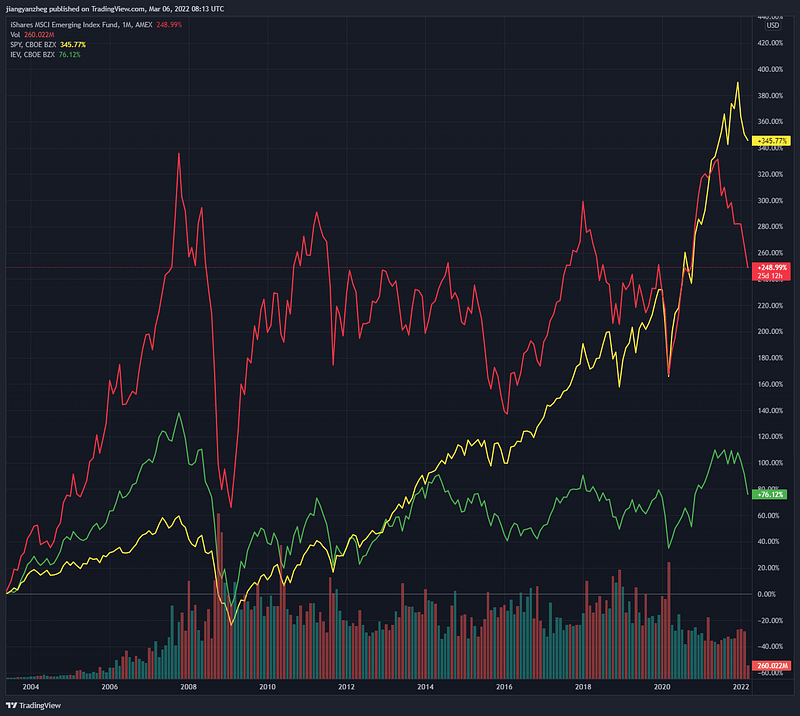

From 2002 to 2009, emerging markets experienced a remarkable boom. A comparison of the MSCI Emerging Market Index (Ticker: EEM/Red) with the S&P 500 Index (Ticker: SPY/Yellow) during this period reveals that EEM achieved a staggering return of 226.7%, while the S&P 500 lagged with a mere 16.8%.

Source: Author/Trading View

As we know, the aftermath of the financial crisis turned the tables, and emerging markets fell behind the US. Many young investors today may not remember a time when the US market struggled not only against emerging markets but also against a sluggish Europe (Ticker: IEV/Green, see below chart). This historical context sheds light on the perceived golden age of the US market since the pandemic crash.

Source: Author/Trading View

To illustrate, if I had $1,000,000 at the start of 2002 and it grew to $1.5 million in five years, I would likely feel content. However, consider the emotional aspect of investing: how would you feel if friends saw their investments soar from $1 million to $4.5 million while yours only reached $1.42 million?

Would you prefer a salary of $300k while others earn $500k, or $100k while they receive $50k? The former scenario might leave you feeling envious. Are we mistakenly viewing short-term successes as indicative of lasting trends?

Photo by NOAA on Unsplash

Reflecting on the Zhihu article, I recognized parallels between the current tech boom and the past rise of emerging markets. Investors, swayed by self-proclaimed experts, were led to believe future growth would stem from these markets, sidelining the US.

For the past five years, professionals have consistently advised underweighting US investments, a concept that many are struggling to accept. Today, even as tech companies face downturns, investors cling to the belief that innovation will drive future growth, often neglecting the importance of actual earnings.

While I am not suggesting that past investments in emerging markets equate to today's tech investments in the US, the narratives we create about these sectors are strikingly similar. The focus here isn't solely on emerging markets; Europe is included in this analysis as well.

As we navigate the present, it's vital to question whether we are overvaluing short-term successes as permanent. This reflection is particularly important during volatile periods before committing our finances.

This article is intended for informational purposes only and should not be construed as financial or legal advice. For any significant financial decisions, consulting a qualified professional is recommended.

Chapter 2: Investment Insights and Opportunities

In light of current market trends, it's crucial to identify potential investment opportunities that could shape the upcoming decade.

The first video titled "This Is The Best Investing Opportunity This Decade (Don't Miss It)" explores key strategies and insights that could impact your investment decisions moving forward.

The second video titled "The 3 Best Investment Opportunities This Decade" outlines the top three sectors to watch in the coming years.