Navigating the Financial Turbulence: Market Trends and Insights

Written on

Chapter 1: Market Overview

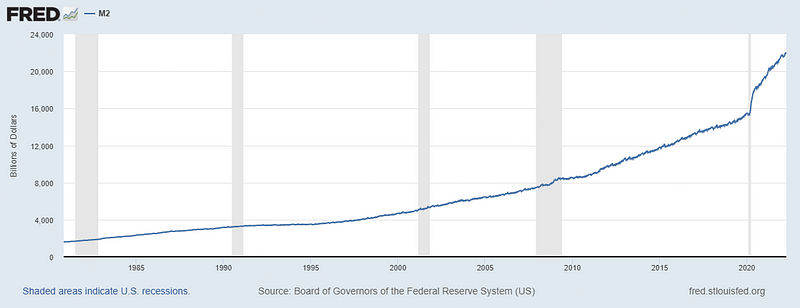

The past couple of years have been rather eventful, particularly in financial circles. Government stimulus and an increased money supply from the Federal Reserve led to a flourishing investment landscape, with asset values soaring higher than pre-pandemic levels. However, it appears that the markets are now stabilizing after a period of excessive growth. With the contraction of the money supply already in motion, we are witnessing the onset of a financial downturn, evidenced by various industries indicating that this prosperous phase is coming to an end.

This paragraph will result in an indented block of text, typically used for quoting other text.

Section 1.1: Stock Market Challenges

Recent trends indicate that stock markets have faced significant challenges. The S&P 500 has experienced an 8% decline in the last month and a total drop of 13% this year.

In particular, technology stocks are suffering the most due to a mix of fundamental and macroeconomic factors, with the NASDAQ down 20% year-to-date. A recent tweet suggested that this has been the most challenging month for the NASDAQ since 2008. For instance, one of my preferred tech investments, AMD, has plummeted by 43% this year—leading to considerable disappointment in my Vanguard account.

Yet, there may be a glimmer of hope. The three main concerns impacting the stock market—the Federal Reserve's actions, the ongoing Russia-Ukraine conflict, and China's lockdown measures—have been dominating news cycles. The optimist in me holds onto the belief that positive developments may arise from any of these issues soon.

Subsection 1.1.1: Energy Market Dynamics

The aforementioned issues are also affecting the energy sector. Power and natural gas prices have been extraordinarily erratic, with a significant uptick in prices until very recently.

From March 29 to April 18, 2022, forward curves for natural gas prices surged by 50%. However, by April 22, prices fell, showing that they had only risen by 25% compared to March 29. This shift suggests that prices may have reached their peak. Moreover, financial institutions are adjusting their strategies. Companies that previously refrained from locking in profits, hoping for further price increases, are now opting to secure their cash flows. Other large entities are stepping back from certain financial swaps due to heightened risk exposure. This behavior indicates that prices might be excessively high, posing considerable risk for some firms.

Section 1.2: Housing Market Insights

A recent CNBC article titled "Home prices jumped nearly 20% in February, but slowdown may be coming, S&P Case-Shiller says" reflects the ongoing dynamics in the housing market. Over the last two years, the market has remained robust, driven by supply-demand fundamentals and monetary policy. The fact that home prices surged by 20% year-over-year certainly caught my attention.

Part of the rationale behind the rise in asset values—including real estate, stocks, and cryptocurrencies—can be attributed to the increase in money supply, which surged during the pandemic's early days.

An increase in the money supply diminishes the dollar's value, leading to higher prices as more dollars are required to purchase assets. Recently, the Federal Reserve has alarmed investors with potential plans to raise interest rates by 0.50% at their next meeting. The real concern for the markets lies in how they manage their balance sheet, as reducing asset holdings could further decrease the money circulating in the economy.

Chapter 2: Reflections and Strategies

The video titled "How to Invest In The Next Stock Market Crash" provides valuable insights into strategies for navigating these turbulent financial times.

As depicted in the video, the lessons from the 2008 housing crisis remain relevant.

Similarly, "The Fed Just Crashed The Stock Market" discusses the recent market impacts of Federal Reserve actions, emphasizing the importance of being prepared.

While the average investor may not operate on the same scale as large financial institutions, there is a common concern: the fear of asset depreciation.

Before making any investments, it is crucial to formulate a strategy. With market volatility expected to persist, it's wise to prepare for unpredictable conditions ahead. The music may not completely stop, but it is likely to slow down.